| description |

The first international activities of the Istituto Mobiliare Italiano - better known by its acronym IMI - date back to 1932, when its president, Teodoro Mayer, suggested to the Board of Directors that part of the capital earned from the discount of promissory notes issued by the representative of the government of the Soviet Union in Italy be used to help the Italian machinery/mechanical sector pay for supplies and manufacturing equipment.

Following a phase of partial isolation from the international economy as a result of the sanctions imposed by the League of Nations on Italy after its 1935 invasion of Ethiopia and Mussolini's subsequent declaration of "autarchy", and in the aftermath of World War II, Italy began its reintegration into the world economy in 1947 thanks to a $100 million dollar line of credit (later increased to $200 million) extended by the Export-Import Bank of the United States for use in advancing Italy's export sector. After being chosen by the Italian government to disburse the funds, IMI quickly set up a representative office in Washington, D.C., that would become increasingly important over time.

The Italian government and IMI shared the task of identifying which businesses to finance, divvying up the funds available between large, medium-sized and small companies and disbursing them to those operating in the four industries - chemical, electromechanical, rubber and steel/mechanical - with the best export potential. Only later would funds be distributed to companies active in other areas as well, such as food, textiles and mining.

In the 1950s IMI became a leader in the field of export credit, and thanks to its growing operations, in 1953 its Foreign Secretariat (Segreteria Estero) began operating as an autonomous office under the leadership of Astorre Oddi Baglioni.

Following the introduction of Italian Law 955/1953, which regulated export insurance mechanisms and contained a measure to provide credit for the export of equipment, it was deemed necessary for the three entities involved - IMI, Mediobanca and Ente Finanziamenti Industriali (EFI) - to coordinate among themselves. Thus in 1954 the Union for Export Initiatives (Sindacato di Iniziative per l'Esportazione - SIE) was created for the purpose of identifying new markets and promoting the export of Italian products. Initially, the three institutes worked well together, but disagreements arose soon thereafter, with each beginning to divide the market up into separate areas in order to manage its own activities independently rather than to continue cooperating together based on a shared strategy.

Export credit was a valuable tool for expanding Italian interests throughout various parts of the world, not only in South America (where IMI handled the export of 30,000 Lambrettas to Argentina, and the construction of an Innocenti steel factory on the Orinoco river in Venezuela) and in the Soviet-bloc countries (where it provided credit to the Soviet Union to finance Fiat's construction of an enormous plant in Togliattigrad), but also in Africa, where it entered into a range of agreements with developing countries for the construction of gas, methane and oil pipelines, often following agreements made by ENI for the import of hydrocarbons. Thus it was thanks in part to IMI that Italy became increasingly important not only as an exporter of equipment and services, but also as a supplier of major works through its subsidiary Italconsult.

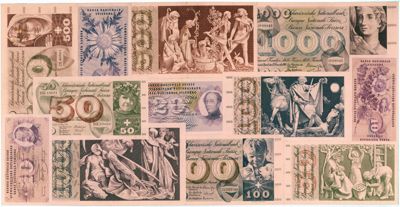

After the Italian government established a tax exemption program, low-interest loans and economic facilitations to foster industrial development and spur foreign investment in the country, and against the backdrop of increased interest by North American investors in the area of the European Single Market, IMI created the Investment Information Office (IIO) in 1958. Its task was to direct potential foreign investors to institutions and consultants able to provide them with expert advice, creating the best conditions for the success of their investments; to assist them in their relations with the Ministries of Industry and Foreign Trade; and to create useful informational materials. Initially IMI offices were active in Rome, Milan and Washington, D.C.; later one was set up in Zurich as well.

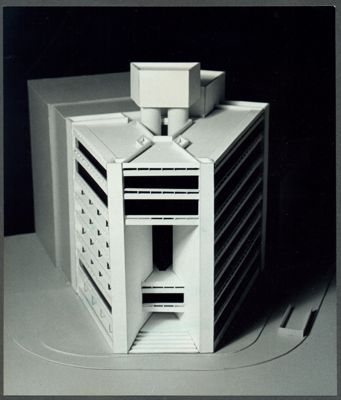

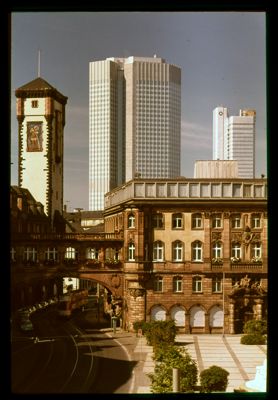

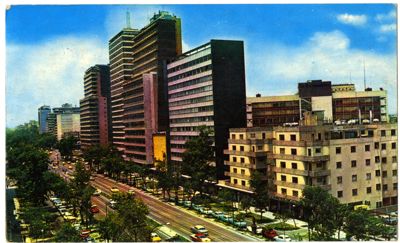

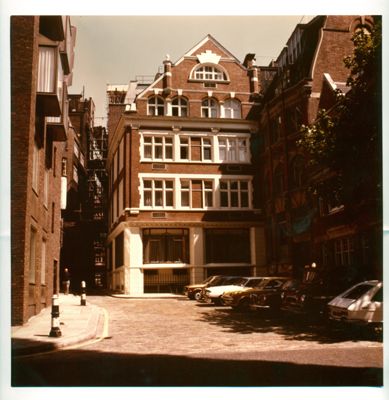

Although IMI operated in numerous parts of the world and dealt with a broad range of foreign states, it established a direct presence only in key cities: after opening its Washington, D.C., office, it also set up representative offices in Zurich (1954), Mexico City (1957), London (1971) and Frankfurt (1983) too.

After Sanpaolo IMI was formed in 1998, the new banking group incorporated IMI's foreign network as well as that of Istituto Bancario San Paolo's.

ESSENTIAL BIBLIOGRAPHY:

Francesca Pino, Alessandro Mignone, Memorie di valore. Guida ai patrimoni dell'Archivio storico di Intesa Sanpaolo, Hoepli, Milano, 2016

Francesca Pino, Matilde Capasso, Giorgio Lombardo, Il patrimonio archivistico dell'Istituto Mobiliare Italiano, Archivio Storico di Intesa Sanpaolo, "Monografie", Milano, 2011

Filippo Sbrana, L'IMI e il credito all'esportazione. 1950-1991, Il Mulino, Bologna, 2006

|

![Istituto Mobiliare Italiano, Whashington representative office's architectural model on Dupont Circle (Euram Building), [1969] (photographer unknown)](/world-map/image-t/IT/ISP/FT00001/0011558/IT.ISP.FT00001.0011558.0001.jpg)